schedule c tax form calculator

1040 Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes. Usually people who file a Schedule C Tax Form will also have to file a Schedule SE Tax Form.

Indie Authors Should Consider Using Schedule C Tax Forms Irs Tax Forms Irs

If you have a loss check the box that describes your investment in this activity.

. Report your income and expenses from your sole proprietorship on Schedule C Form 1040 Profit or Loss from Business Sole Proprietorship. The amount of unreimbursed business expenses from Form 2106 andor business expenses included on Schedule C must be adjusted for the percentage of tax-free income received ex. A Schedule C is a tax form filed with your personal tax return that helps you calculate the profit or loss from your business.

Self-Employed defined as a return with a Schedule CC-EZ tax form. However you can deduct one-half of your self. Were going to review this in detail below.

Use Tax Form 1040 Schedule C-EZ. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. If a loss you.

Online is defined as an individual income. Based on your annual taxable income and filing status your tax bracket. Form 1040 Schedule C-EZ.

Name of proprietor. Profit or Loss From Business. Profit or Loss From Business as a stand alone tax form calculator to quickly calculate specific amounts.

Form 1040 Schedule C. Online competitor data is extrapolated from press releases and SEC filings. Use our Tax Bracket Calculator to answer what tax bracket am I in for your 2021-2022 federal income taxes.

Information about Schedule C Form 1040 Profit or Loss from Business. You may also need Form 4562 to claim depreciation or Form 8829 to. This means that youll multiply your net earnings by 01530 to arrive at the amount of self-employment tax you need.

Based on your projected withholdings for the year we can also estimate your. If the total of your. Use Tax Form 1040 Schedule C.

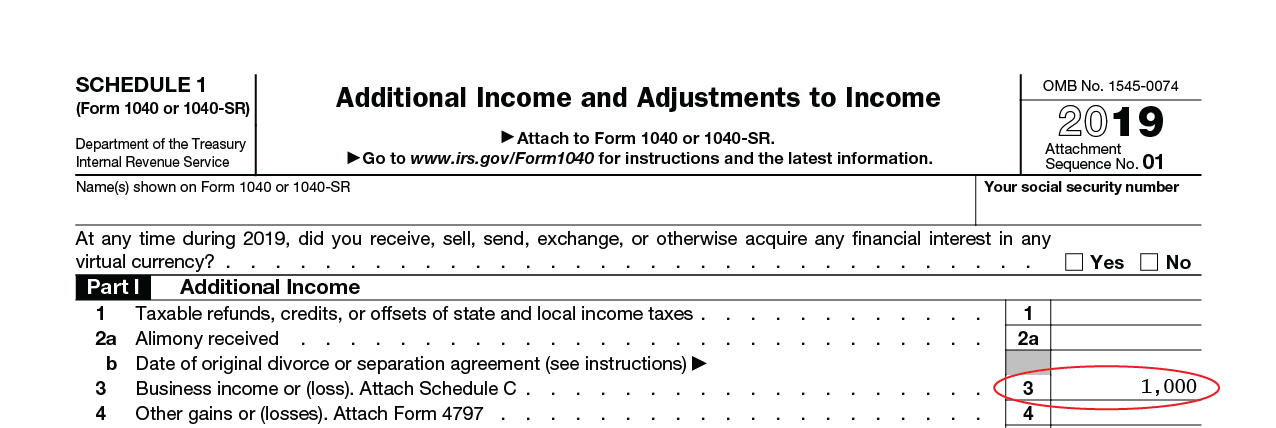

Form 1041 line 3. Plan contributions for a self-employed individual are deducted on Form 1040 Schedule 1 on the line for self-employed SEP SIMPLE and qualified plans and not on the. Use it to tell the government how much you made.

If you checked 32a enter the. Online competitor data is extrapolated from press releases and SEC filings. There are clear instructions in lines 3 5 and 7 but here.

Net Profit from Business as a stand alone tax form calculator to quickly calculate specific amounts. About Form 1041 US. For the tax calculators below be sure to have your 1099 or W-2 form handy and be ready to answer a few basic questions about your filing status income deductions and.

Net Profit from Business. Online is defined as an individual income. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Income Tax Return for Estates and Trusts. Make tax season a breeze. Up to 7 cash back The current rate of self-employment tax is 1530.

About Form 1099-MISC Miscellaneous Income. This is where Schedule C starts to look like a tax form rather than a straightforward information document. The first section of the Schedule C is reserved for your business information.

If you file using a software install our plug-in and well tell you the numbers you should enter at every step to prepare your taxes. Go to line 32 31 32. If you have a tax advisor or.

/GettyImages-1124618357-6ad8403bf64b466db2969a59262bffe1.jpg)

All About Schedule A Form 1040 Or 1040 Sr Itemized Deductions

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

Irs Crypto Tax Forms 1040 8949 Koinly

Schedule C Instructions With Faqs

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Step By Step Guide For Filling Out A W 4 Form Workest

5 Printable Schedule C 1040 Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Form 1099 Schedule C Business Expenses Blog Taxbandits

Demystifying The Form 1118 Foreign Tax Credit Corporations Part 3 Schedule C Tax Deemed Paid With Respect To Section 951 A 1 Inclusion By Domestic Corporation Filing Return Section 960 A Sf Tax Counsel

Tax Calculator For Self Employed Online 60 Off Ilikepinga Com

Free 9 Sample Schedule C Forms In Pdf Ms Word

What Is A Section 121 Exclusion

Is The Schedule 1099 C A Blessing Or A Curse Mi Money Health

The Schedule K 1 Form Explained The Motley Fool

How To Calculate Earned Income For The Lookback Rule Get It Back

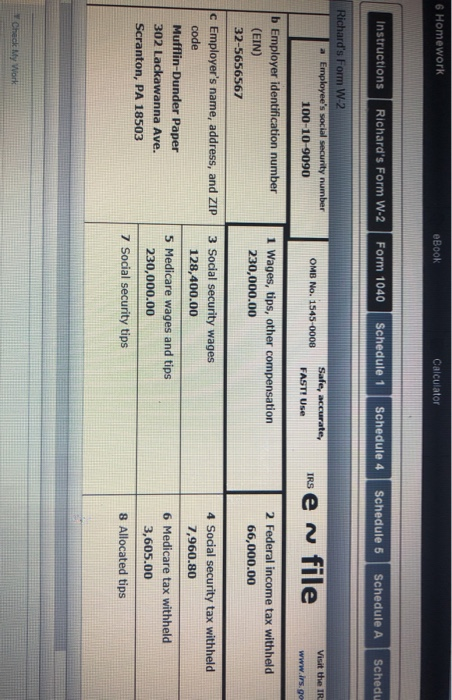

Need Help Completing The Rest Of Form 1040 How Do You Chegg Com

The Schedule C Calculator That Simplifies Your Freelancer Tax Life

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

Artists What To Know About Schedule C Deductions Nyack News Views